Public Accounting: Definition, Functions & Examples

Contents:

Depending on your personal and professional priorities, working in public accounting may come with both positives and negatives. If public accounting seems intriguing, it’s only one side of the accounting industry. There are also a multitude of career opportunities in the other major sector—private accounting.

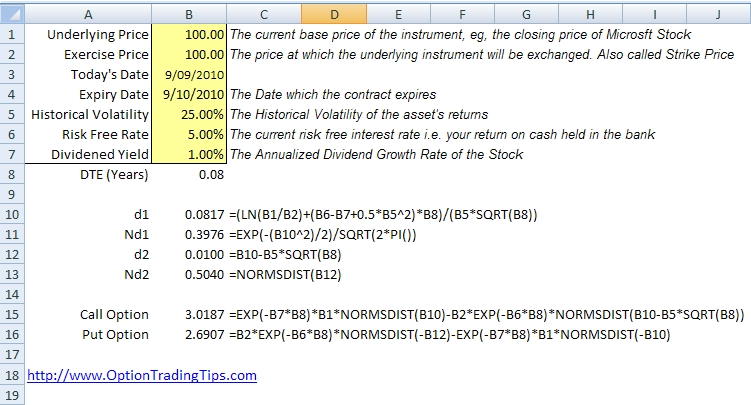

Financial accounting refers to the processes used to generate interim and annual financial statements. The results of all financial transactions that occur during an accounting period are summarized in the balance sheet, income statement, and cash flow statement. The financial statements of most companies are audited annually by an external CPA firm. It may be handled by a bookkeeper or an accountant at a small firm, or by sizable finance departments with dozens of employees at larger companies.

Ways To Manage Your Business Accounting

For these reasons, private accounting is often considered the more stable choice for day-to-day work. Private accountants, on the other hand, are trained in the processing of a variety of accounting transactions, such as accounts payable and billings. The knowledge of private accountants may be limited to the work they are responsible for. From an organization’s perspective too, availing public accounting services is worth it. This is because there is an assurance that the financial tasks will be completed on time and in accordance with the legal requirements.

- Public accountants, also called certified public accountants , are qualified to help other businesses as well as individuals with their tax needs.

- It’s important to remember that while this is a side-by-side comparison, the path you choose doesn’t have to be permanent.

- Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics.

- Both public and private accounting can include management positions at some point in the career path.

- Several factors may determine the decision, including the job responsibilities, the daily routine that comes with the profession, one’s strong skills, and career goals.

Personnel assist https://1investing.in/ with the direct preparation of their financial statements. This can include the handling of many accounting functions on an outsourced basis. Participate in internal and external audits conducted to ensure compliance with required County, State or Federal programs, procedures and requirements. The average Public Accountant salary is $76,367 as of March 28, 2023, but the salary range typically falls between $62,963 and $97,448. Salary ranges can vary widely depending on many important factors, including education, certifications, additional skills, the number of years you have spent in your profession. With more online, real-time compensation data than any other website, Salary.com helps you determine your exact pay target.

It is categorized as current liabilities on the balance sheet and must be satisfied within an accounting period. Public accountants may experience a somewhat difficult work environment that involves travel, long hours, and tight deadlines. I really appreciate hearing about the experiences of both you and your roommate. I’m leaning towards financial audit, but I know the hours can be terrible. I think there’s a lot of truth in what you said about the team either making or breaking it, but the nerve wracking thing would obviously be that you have little control over your team.

Accounting Clerk

Individuals with the CPA designation can also move into executive positions such as controllers or chief financial officers . For many years, I worked in public accounting as an auditor and consultant. I really enjoyed working on various types of projects with different clients. I worked with many different not-for-profit organizations and found that I have a passion for mission-driven organizations. Although tax returns are not open to the public, they fall under the public accounting umbrella due to the legal requirement of disclosing financial information to the government.

For example, entry-level CPAs earn an average salary of $54,400, while mid-career CPAs earn an average of $71,580 annually. While many CPAs offer tax preparation services, they can also work in government agencies, nonprofit organizations, and self-employment. Public accounting refers to the branch of accounting that involves a specialized firm offering services to several clients. Usually, it involves accountants working for a firm that provides various services that relate to finances.

Certificate Programs

For this reason, there are several broad groups that most accountants can be grouped into. Full BioMichael Boyle is an experienced financial professional with more than 10 years working with financial planning, derivatives, equities, fixed income, project management, and analytics. As you fulfill the CPA requirements, it’s a good idea to keep your job search materials updated, including your resume and LinkedIn profile. It’s also a good idea to improve your interviewing skills, such as researching a company, preparing questions to ask the hiring manager, and presenting your qualifications. You may find that for some accounting positions, employers require or prefer candidates with a master’s degree.

- You’ll probably need the support of other financial professionals, like certified financial planners, to help shepherd your financial life.

- RSM is the sixth largest accounting firm of the top 10 accounting firms in the world.

- To help, we created this handy guide to help you decide if you’re better suited for public or private accounting.

- The formation of the institute occurred in large part due to the Industrial Revolution.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. External investors want confidence that they know what they are investing in. Prior to private funding, investors will usually require financial statements to gauge the overall health of a company. Banks and other lending institutions will often require financial statements in compliance with accounting rules as part of the underwriting and review process for issuing a loan. Under the cash method of accounting, a journal entry is only recorded when cash has been exchanged for inventory. There is no entry when the order is placed; instead, the company enters only one journal entry at the time the inventory is paid for.

debits and credits accounting, on the other hand, points to an in-house accountant or an accounting team handling your financial information, taxes, audits, etc. Explore our list below to discover which organizations offer the best fit for public accounting professionals. Earning a general accounting degree helps you pursue employment in different finance sectors. Understanding basic accounting principles gives you a comprehensive look into the overall scope of a business as required by various finance roles. A bachelor’s in public accounting usually involves similar courses as a general accounting degree.

How To Start Your Career In Accounting – Opportunity Desk – Opportunity Desk

How To Start Your Career In Accounting – Opportunity Desk.

Posted: Thu, 13 Apr 2023 00:00:00 GMT [source]

These accountants are employees of an external entity that serves various clients. In contrast, private accountants are employees of a company or entity and provide services to it only. Public accounting is a branch of the accounting field that considers where accountants work.

Becoming a CPA

Additionally, there may be more education and CPA certification required for many accounting firms. Being a certified public accountant is usually a requirement for public accountants. Accountants won’t need to become certified public accountants to start in public accounting, but they usually need to be a CPA to move into management positions at their firm. Different states have different requirements for becoming a CPA, and many states require you have a certain amount of school hours to be eligible to become a certified public accountant. Usually the requirement is over 150 credit hours, or equivalent experience in order to sit for CPA tests.

A company will let you kill yourself but you need to know your own limits and take care of yourself. She worked over 100 hours the last 3 weeks of February, including weekends 9-9 both days. She had to hire a maid to do her laundry because she ran out of clean clothes and didn’t have time to do simple household tasks. She also broke up with her long-term boyfriend in November of that year after moving to be closer to him after college .

Accounting is the process of keeping track of all financial transactions within a business, such as any money coming in and money going out. It’s not only important for businesses in terms of record keeping and general business management, but also for legal reasons and tax purposes. Though many businesses leave their accounting to the pros, it’s wise to understand the basics of accounting if you’re running a business.

Under the Sarbanes-Oxley Act, which was passed in 2002, accountants were subject to tougher restrictions about their consulting assignments. Public accounting firms hire accountants that specialize in these areas. Based on the client’s needs, they allocate their staff to every project or job. On top of that, these firms have partners or directors that overlook specific projects. The essence of these firms is the highly-specialized services provided by the staff.